Australian businesses are behind their international counterparts in employing data analytics, but this isn’t because they don’t want to. The unspoken problem is the lack of information provided informing businesses about how they can use their data correctly.

Sadly, it isn’t as simple as analysing customer numbers, sales or demographics data. While this information is particularly important to know and understand, it will only go so far. Business owners need to gain the knowledge to interpret their data over time and create insights from analysing different data sets and sources to truly reap the benefits.

In this article we explore four ways businesses often tend to use data incorrectly and what steps can be taken to do it correctly.

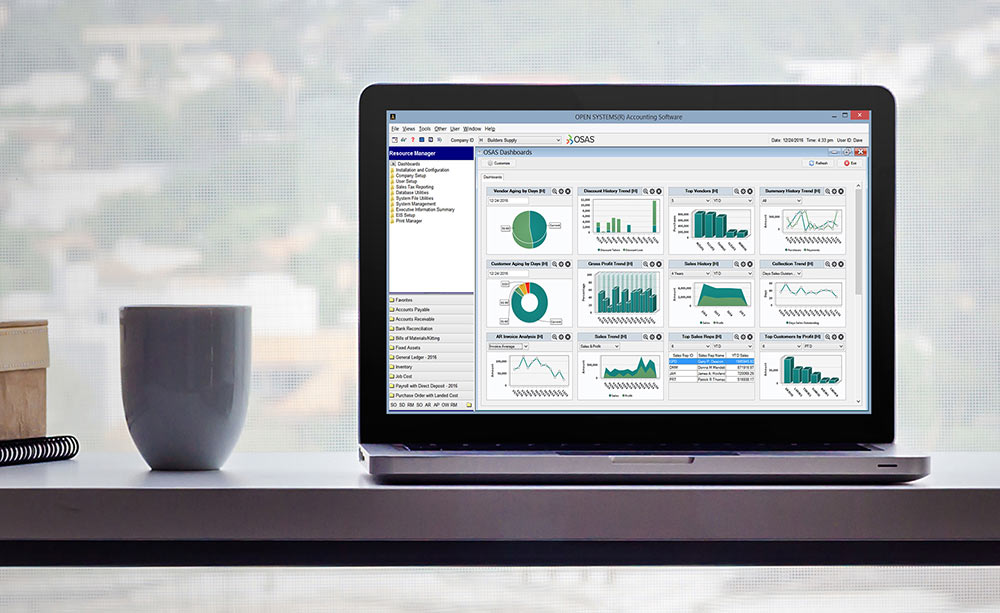

1. Selecting and using the wrong technology

Sometimes businesses can get involved in conversations about data science and AI, ultimately implementing software and tools just to ‘tick the box.’ Issues often arise when the wrong strategies are used, or enough time hasn’t been taken to select the right technology for their situation. This decision should never be rushed and an understanding developed that by simply having the technology doesn’t mean the job is done. A proper strategy needs to be implemented.

In many cases, SMEs don’t need the most advanced tools or software solutions. Often only a simple platform that performs data analytics quickly, allows business owners to gather the insights they require in a small amount of time.

2. Avoiding or providing insufficient training and education

Having all your employees at all levels trained in the software and applications you use will ensure everyone understands the data and can make timely decisions. Making access available to everyone will ensure all people in the company are equipped to solve problems quickly and independently.

Ensuring all staff are trained to use new data tools is key to ensuring specific job roles or departments best positioned to make relevant business decisions or solve problems.

3. Analysing the wrong data

Maximising the value of your data means looking at the right data to support strong and effective decision making. For example, a business can use data to see that cancellation request rates are unusually high, however if they don’t look at the right details, they won’t understand why. Without looking at complementary data, these numbers do little to help businesses figure out why people are cancelling their bookings. If they were to look at data from different sources and bring it all together, they are far more likely to determine if cancelations are being made because of product issues, customer service, pricing or something else.

Demographic data may highlight an issue with customers in the same location which could mean an issue with a staff member in that area, or a new competitor in the market offering a better product or price. This could prompt the business to investigate their staff member’s customer service or how they could compete better in this location by changing price or adding value to the offer.

Businesses can use their data to investigate an issue further and allow them to make informed decisions based on the facts.

4. Failing to take action fast enough

Once data reveals an issue or problem or answers key questions, making quick decisions and actions is essential. If the data highlights that customers in a particular area are leaving it may indicate your pricing is too high or better value can be gained by moving to a competitor, time is of the essence to ensure you don’t lose them forever. Taking too long to act can hold businesses back unnecessarily and reduce the value of having the data software in the first place.

Small businesses that are growing, often have a lot to lose. It is essential to use customer data effectively and invest in the right processes. Focus needs to be placed on how SMEs can make use of their data in the most useful and productive ways. For many micro businesses, it is particularly important to maximise data analytics tools, so the benefits can be achieved without diminishing valuable time and money.