When introducing new technology to your accounting process, you want the best software and apps to streamline your bookkeeping. Managing your own small business requires performing many different roles on any given day. If you need some help to streamline your functions and gain some efficiencies, there is probably an app for that. In fact, there are several apps for that. Once you start looking into the world of bookkeeping software and apps, you quickly realise that the amount of choice is overwhelming. There is software for every size and style of business regardless of how financially literate you are. Most financial software is scalable depending on the size of your business and many of them provide add-ons if you decide to expand the scope of your business in the future.

This is a quick guide of our top recommended bookkeeping and accounting apps for businesses that will change your life and make you wish you had got on board earlier.

Xero

There are different versions of Xero’s accounting software which allows you to choose the one that’s right for you. Most of the versions include payroll software to help manage your payroll (including single touch payroll) in the same place as the rest of your business expenses.

Features: Invoicing, bank connections, information security, inventory, bank reconciliation, pay bills, payroll, customisable performance dashboard, GST returns, quotes, purchase orders, basic CRM and financial reports. Add-Ons: Xero Expenses, Xero Projects.

Pricing: Payroll Only – $10/month; Starter – $25/month; Standard – $50/month; Premium – $65 – $150/month (payroll for 5-100). Optional Extras: Projects – $10 for 1 user/month + $7 for each additional active user / month. Expenses – $5 for 1 user/month + $5 for each additional active user/month.

QuickBooks

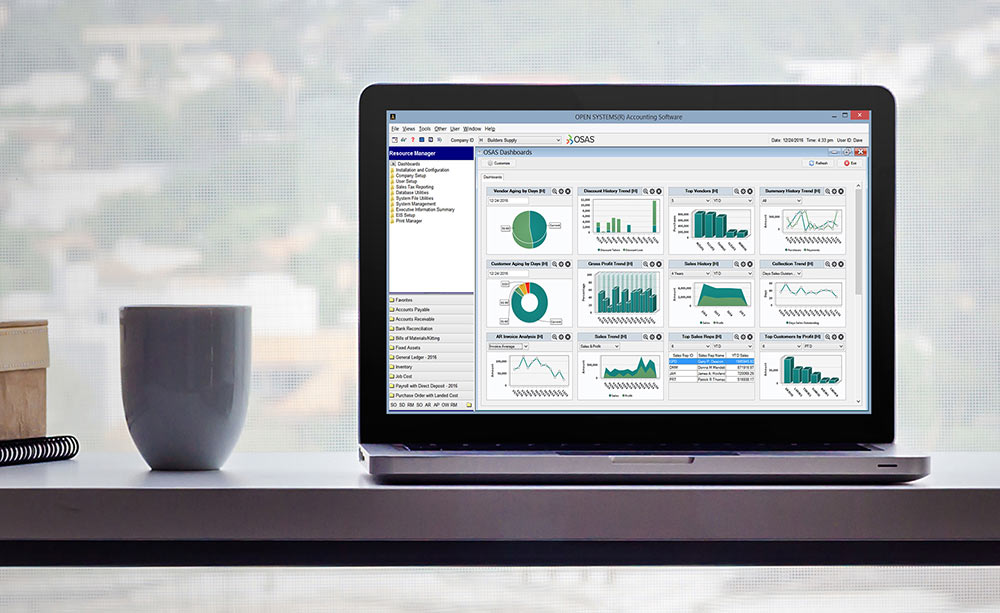

QuickBooks provides desktop, online and app versions and is cloud-enabled so that your financial data will sync across all relevant platforms. QuickBooks has been around since the 1990s and provides a wide variety of services which you can tailor to your needs.

Features: All plans allow you to track income & expenses, maximise tax deductions, invoice & accept payment, run reports, send estimates, track sales & sales tax, capture & organise receipts, and integrate apps (i.e. PayPal). The Essentials and Plus Plans provide greater tracking capabilities as well as additional users. Payroll functions can be added for an extra cost.

Pricing: Simple Start – $15/month for one user; Essentials – $25/month for up to three users; Plus – $35/month for five+ users.

MYOB Essentials

MYOB Essentials is designed for Australian small businesses. It is a fast and easy way to handle day-to-day bookkeeping requirement. Its tax updates also ensure you don’t get caught out when it comes to tax time.

Features: Bank feeds, automatic tax updates, instantly track and create GST, PAYG and BAS reports, lodge reports with the ATO, payroll and STP reporting, invoicing, expenses, smart bills and a wide range of add-ons.

Pricing: Accounting Starter – $13.50/month; Accounting – $24/month; Accounting + Payroll – $30/month

Receipt Bank

Receipt Bank provides automation for collecting, processing and publishing receipts and invoices. It extracts the data from your paperwork allowing you to skip manual data entry and compile bookkeeping and expense data more easily.

Features: Automated scanning, accurate data extraction, fully secure payments, flexible data export, foreign currency support, automated submission requirements.

Pricing: Pricing is based on the number of items processed per month and whether you require a single user or multi-user plan. Single user plans range from $19.95/month for 50 items to $249.95/month for 675 items. Multi-user plans range from $30/month for 50 items to $290/month for 675 items. More plans are available upon request.

Hubdoc

Hubdoc is another service that helps you to collect all of your financial and bookkeeping data in one place. It gathers information from imported paperwork and converts it into useable financial data. If connected to your accounts it can also collect and process data automatically.

Features: Snap & Send paperwork, Auto-Pilot for bills and statements, export documents, collaborate, bank-level security, auto-filing & sorting, connect to accounts, pull historical bills & statements, integrates with other platforms.

Pricing: $20 USD/month

All of these software options have limited free trials or money back guarantees, so try out any that you are interested in to make sure they are the perfect fit before you buy. If you need help figuring out your financial needs, then chat with one of our experienced accountants about the best options for you. All of our monthly accounting contracts include a subscription to Xero and Receipt Bank. Find out more info by calling us today on 1300 ARABON or visit our website for more information.